NON-DOMESTIC RATES BILL CHANGES TO LEGISLATION IN SCOTLAND

On 5th February The Scottish Parliament passed into Legislation The Non Domestic Rates (Scotland) Bill.

This new Primary Legislation provides the necessary framework for the changes to the Scottish Non-Domestic Rates System and more importantly provides the Scottish Assessors Association and Local Authorities with increased powers to obtain information and introduces substantial fines for noncompliance.

INCREASED ASSESSOR POWERS AND THE INTRODUCTION OF CIVIL PENALTIES

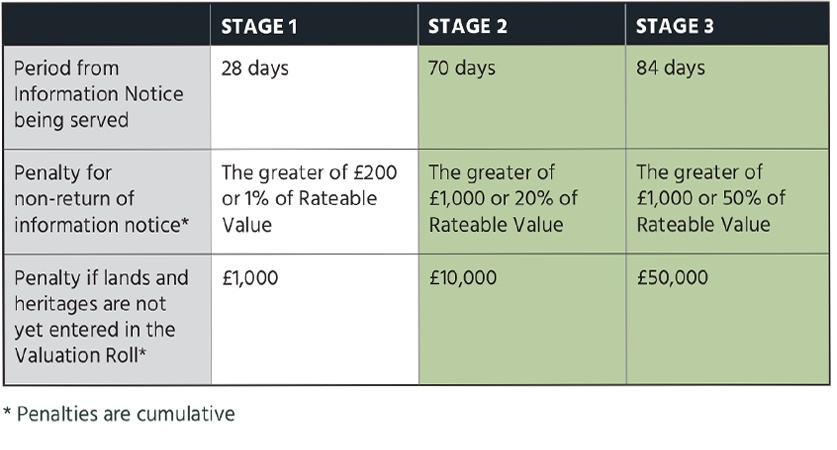

From the 1st April 2020 penalties can be issued for non-return of information in respect of a Rent Return of Information, Cost Return of Information or Trade Return of Information.

The Assessors may issue a form to:

- any person who the Assessor thinks is a proprietor, tenant or occupier of lands and heritages; and/or

- any other person who the Assessor thinks has information which is reasonably required for this purpose.

The timescales and penalties for return of such requests are substantially more onerous than in England and Wales and are summarised below.

It is imperative that any request received is directed to the appropriate person within your organisation and are acted on within the statutory time limit.

Graham Howarth

IMPORTANT ACTION REQUIRED ON RECEIPT OF A REQUEST

We have serious concerns that the level of penalties are excessive in relation to the nature of the request but despite industry wide lobbying they have been passed into the legislation.

It is therefore imperative that any request received is directed to the appropriate person within your organisation and are acted on within the statutory time limit.

We can assist you with the return of these forms, but you will need to be able to provide us with any information required in order to allow us to comply with the strict time limits in place. As a result of these legislative changes an additional fee may be required to cover our time in completing these forms to the Assessor within the tight timescales provided.

The party to whom the form is issued will be liable for any fines for non-completion which are cumulative.

INCREASED LOCAL AUTHORITY POWERS

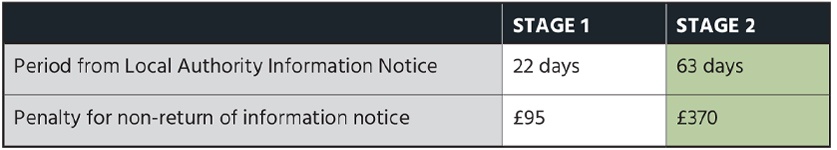

In addition to the increased powers provided to the Scottish Assessors, Local Authorities also have been provided with increased powers to collect business rates and information from ratepayers.

The timescales and penalties do differ from that provided to the Assessors.

The Non-Domestic Rates (Scotland) Bill provides the Local Authorities to commence debt recovery quicker. Where no payments are made, the Local Authorities can apply to recover the full amount due for non-payment. This will commence earlier in the financial year (June/July) in comparison to October as currently in place.

Local Authority information notices may take the form of information requests for details relating to the paying, collecting and updating etc required by Local Authority finance departments for Non-Domestic business rates administration/billing.

These are major change to the powers provided to the Scottish Assessors, Local Authorities and we will have to wait to see how ready they are to exercise their powers to issue fines. It is important that they are not given the opportunity to test these powers and that your teams are aware of the importance of acting swiftly on receipt of a request.

For assistance contact your Client Partner.

Related Services

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |