Rating Update - Autumn Statement 2022

The Chancellor delivered his Autumn Statement this morning with good news for ratepayers who had been facing uncertainty over their business rate liabilities from April next year.

We are particularly pleased that the Government has listened to our calls to remove any inflation linked increase to the multiplier confirming that the Uniform Business Rates (UBRs) in England will again be frozen for 2023/24. It has also scrapped downwards transitional adjustments and instead caps on increases will be funded by Government.

Budgeting for 2023 rate liabilities

The government have issued a factsheet. Here is a summary of the key points:

Multiplier (UBR)

The UBR in England is to be frozen for 2023/4 at 49.9p for small properties with a rateable value below RV £51,000, and 51.2p for properties with a rateable value of RV £51,000 or more. This will be the third year in a row that the multiplier has not changed.

For the devolved administrations in Wales and Scotland, the Government will be providing support which would allow those countries to provide similar ratepayer support, but we await announcements to confirm their approach.

Transitional Arrangements

There will be NO downwards phasing – so those ratepayers who see a fall in their rateable value in 1st April 2023 will benefit immediately.

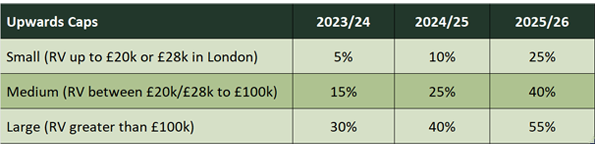

For ratepayers who are facing increases in their rateable values (RV), transitional relief will be provided on the form of the following caps:

Retail, Hospitality and Leisure Relief

The Chancellor has acknowledged that the retail, hospitality and leisure sectors have continued to suffer following the impact of the Covid-19 pandemic and now the cost of living crisis. He has confirmed that the Retail, Hospitality and Leisure Relief scheme will continue for the 2023/4 rate year with an increased discount of 75% (up from 50% during the current year). However, this will unfortunately still be capped at £110,000 per business which means that occupiers of more than a small number of properties will still only see a limited benefit.

Other measures include support for small businesses seeing an increase in assessment at the revaluation which therefore takes them outside the small business rate relief scheme.

Improvement Relief

The improvement relief scheme proposed by the Government in their Technical Consultation issued last year will unfortunately be delayed to 2024. This is disappointing for those businesses who would have qualified and are wanting to invest in their occupied properties.

Draft 2023 Rating List Assessments

Following the Autumn Statement, the draft 2023 Rating List assessments for England and Wales were published this afternoon.

We are in the process of uploading the draft assessments into our system and as soon as this has been completed we will be able to provide clients with updated rate liability forecasts reflecting all of today’s announcements.

As always, we are here to discuss any specific issues regarding your properties and will keep you informed of further developments regarding business rates across the UK.

Related Sectors & Services

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |