Aviation Business Rates

A return to confidence

The aviation sector has substantially rebounded from what has been a challenging time since early 2020. Sustainability and agility have shaped the recovery, as aviation businesses have transformed their operations.

As airports, operators and other aeronautical industries respond to these changes, they must budget prudently and intelligently. With rates liabilities representing a substantial portion of operating costs, considered forecasting of future rates bills can provide confidence to wider business strategies in an increasingly competitive environment. Coupled with a technical mitigation strategy, our approach to your rates liabilities can offer resilience to your wider aviation business.

Impact of Revaluation 2023 on Aviation

For the 2023 Revaluation, the Valuation Office Agency (VOA) proposed a fundamental change to the basis of assessment for civil airports in England and Wales, departing from a replacement cost approach to rating assessments based on profit. This is helpful for some less profitable airports but can lead to significant increases in liability at typically larger more profitable airports.

The impact of the change in valuation method has been reduced by considering the impact of the global pandemic on the 2023 Revaluation. However, the impact of the change will be much more significant at the next revaluation in 2026 when airports have fully recovered from the pandemic.

Revaluation 2023

There have been significant increases in airport Rateable Values driven by approximately 40% growth in industrial rents since 2015. The justification for industrial rent increases may only partially apply to airports.

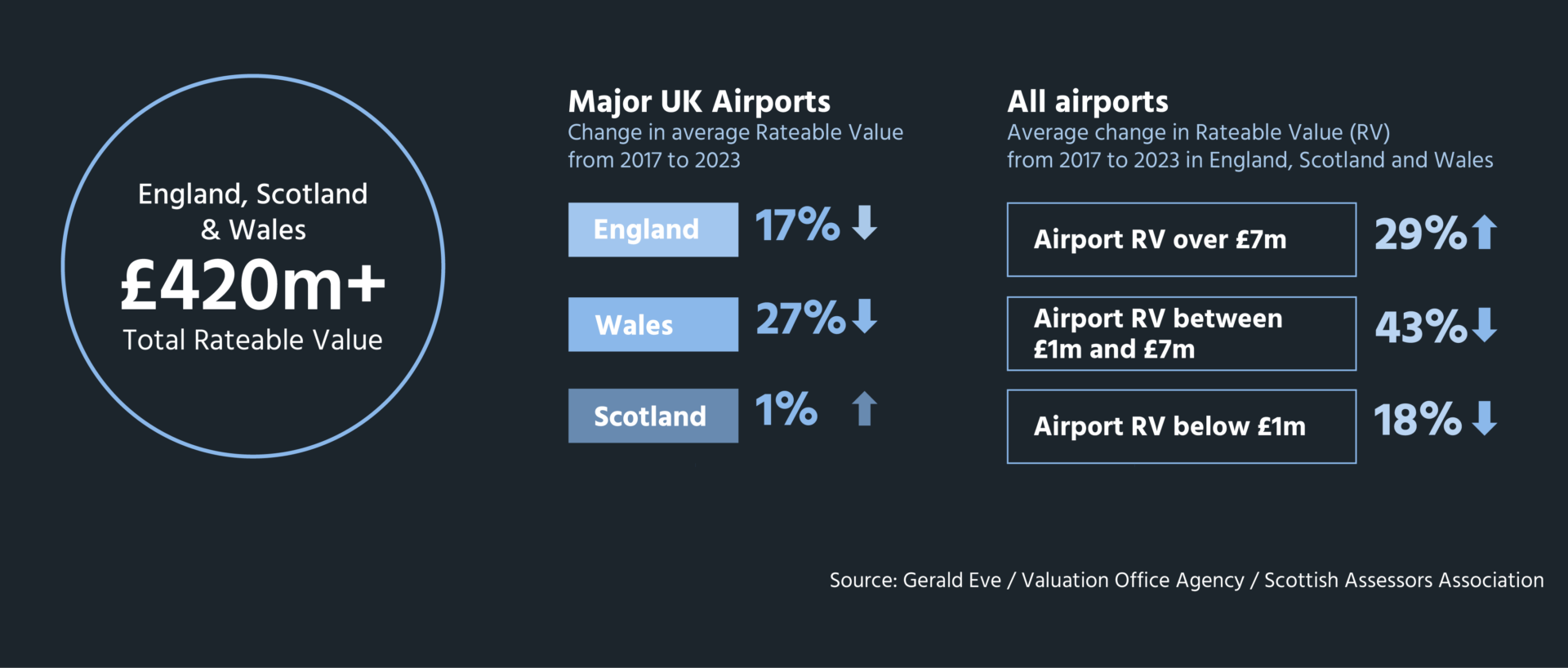

Looking at the overall picture for UK airports is somewhat misleading; the total RV between lists showed a slight fall with an average decrease of 10%. However, a more detailed analysis shows the largest UK airports by 2023 RV, saw an average increase of 29% in RV. Medium-sized airports (by RV £7m to £1m) saw an average fall of 43%. Smaller airports (below RV £1m) saw an average fall of 18%.

While many airports have pre-agreed their Rateable Values for the main airport assessment, many are still to agree. We have already had significant success in reducing our clients’ Rateable Values from the level quoted by the Valuation Office Agency and Scottish Assessors Association.

Revaluation 2026

Given there will be no COVID-19 impact to take into account, many airports will see a significant increase in business rates costs as a result.

In the absence of the pandemic impact and with the new valuation methodology, we expect this combination of factors to have a significant impact on 2026 values for the majority of airports.

The valuation date for the 2026 Revaluation is April 2024 in England and Wales and 2025 in Scotland. The Valuation Office and Scottish Assessors will therefore soon be considering draft valuations for input into the 2026 Rating List and Rating Roll.

In our experience, it is better to discuss valuation factors and values well in advance. Leaving consideration until too late or until after the draft lists have been published may well lead to ratepayers having to pursue any valuation matter through the formal and protracted Check, Challenge, Appeal route.

We are now advising our clients on the steps to take to put them in the best possible negotiating position for the 2026 Revaluation.

Regulatory Compliance

England and Wales

Non-Domestic Rating Act 2023

The Non-Domestic Rating Act 2023 will introduce potentially onerous mandatory obligations on ratepayers to regularly update the tenure and physical details of all properties within their portfolios with the Valuations Office Agency (VOA).

Increasing the administrative burden on businesses, it will require prompt updates to the VOA and annual returns even where there are no changes, with penalty risks for non-compliance. The complexity of business rates management will increase with measures anticipated to be fully in place for the 2026 Revaluation.

Material Change of Circumstance (MCC)

Legislative changes to Material Change of Circumstance provisions took immediate effect in October 2023. They tighten the scope of MCCs in England so that new legislation, licensing regimes and guidance from public bodies will not be grounds for a change in Rateable Value between revaluations.

Completion Notices

For buildings that have been temporarily removed from the rating list during redevelopment, billing authorities will be able to issue Completion Notices in the same way as for a new building. The regulatory changes should be in effect from January 2024.

Scotland

Since January 2023, Scotland’s new legislation has transferred Valuation Appeals to the Scottish Courts Tribunal service. This entails strict deadlines and rigorous requirements for ratepayers and advisors. All appeals against valuations from April 2023 should have been submitted as a comprehensive case with supporting data by 31 August 2023. Learn more about how to appeal business rates in Scotland >

How we can help

We have been advising the aviation sector for many years – from international and regional airports, to support services such as baggage handlers, lounge providers and fuel suppliers. Our team understands the ever-changing needs of the industry, so pertinent in today’s turbulent and uncertain times. Business rates form a significant fixed cost for the sector, which requires expert handling and the best advice. Our flexible rating service is tailored to your specific requirements with the goal of saving you both time and resources.

-

Review and Appeal

We know when to appeal and when to leave well alone. Our experience of a diverse range of estates gives us a real edge in our negotiations. This insight and our forensic attention to detail translates into successful appeal strategies.

-

Budgeting and Forecasting

We provide you with confident forecasting of future bills, particularly given the risk of a change to the rating valuation approach.

-

Minimising Risk

As a member of The Airport Operators Association, Airlines UK, British Aviation Group, Confederation of British Industry and Airport Rating Surveyors Group we shape the thinking on the future of the rating system and we inform the Valuation Office Agency and Scottish Assessors Association thinking from within and in a timely fashion, before entrenched views and positions are adopted.

-

Vacant Properties

We make sure that reliefs for empty properties are realised and we can implement rates mitigation measures to reduce the cost of holding long term vacant space.

-

Exemptions and Reliefs

We ensure reliefs are properly applied and we are at the forefront of devising innovative solutions to problems posed by recent changes to legislation.

-

Historic Rates Audit

Our historic rates audit ensures that past errors and overpayments are resolved and refunded.

-

Rates Payment Management Service (RPMS)

We offer the market leading rate payment management service to ensure you only ever pay the correct rates liability.

Our clients

Some of the clients we work with.

Key Facts

£212m

Advising on the UK’s single largest rating assessment at Heathrow Airport

£1.3bn

client savings since 2017, £3.8 bn since 2010

25%

of the FTSE represented

£1bn

rate liability processed each year as UK's leading outsourced ratepayer

Revaluation 2023

Many businesses may have an opportunity to reduce their business rates liability. Are you one of them?

Learn MoreNEWS AND INSIGHTS

View All InsightsRating Update – Welsh Budget 2025/26 UBRs and Reliefs

2 weeks ago 3 Mins ReadRating Update – Scottish Budget 2025/26 UBRs and Reliefs

3 weeks ago 5 Mins ReadBusiness Rates for the leisure industry: what lies ahead?

3 weeks ago 3 Mins ReadCookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |