Energy and Renewables Business Rates

Navigating the complex

With the drive towards net zero, the UK energy and renewables sector is witnessing dramatic growth in capacity. We have a dedicated energy and renewables team with deep sector knowledge who understand the regulatory and market changes impacting the development and use of assets. This ensures that we provide you with the best advice to budget for and mitigate your business rates liability. Whether it’s evolving technological advancements, developments in government policy or changes in the Valuation Office / Scottish Assessor approach, we’re here to ensure that you are in the best position to manage your business rates liability.

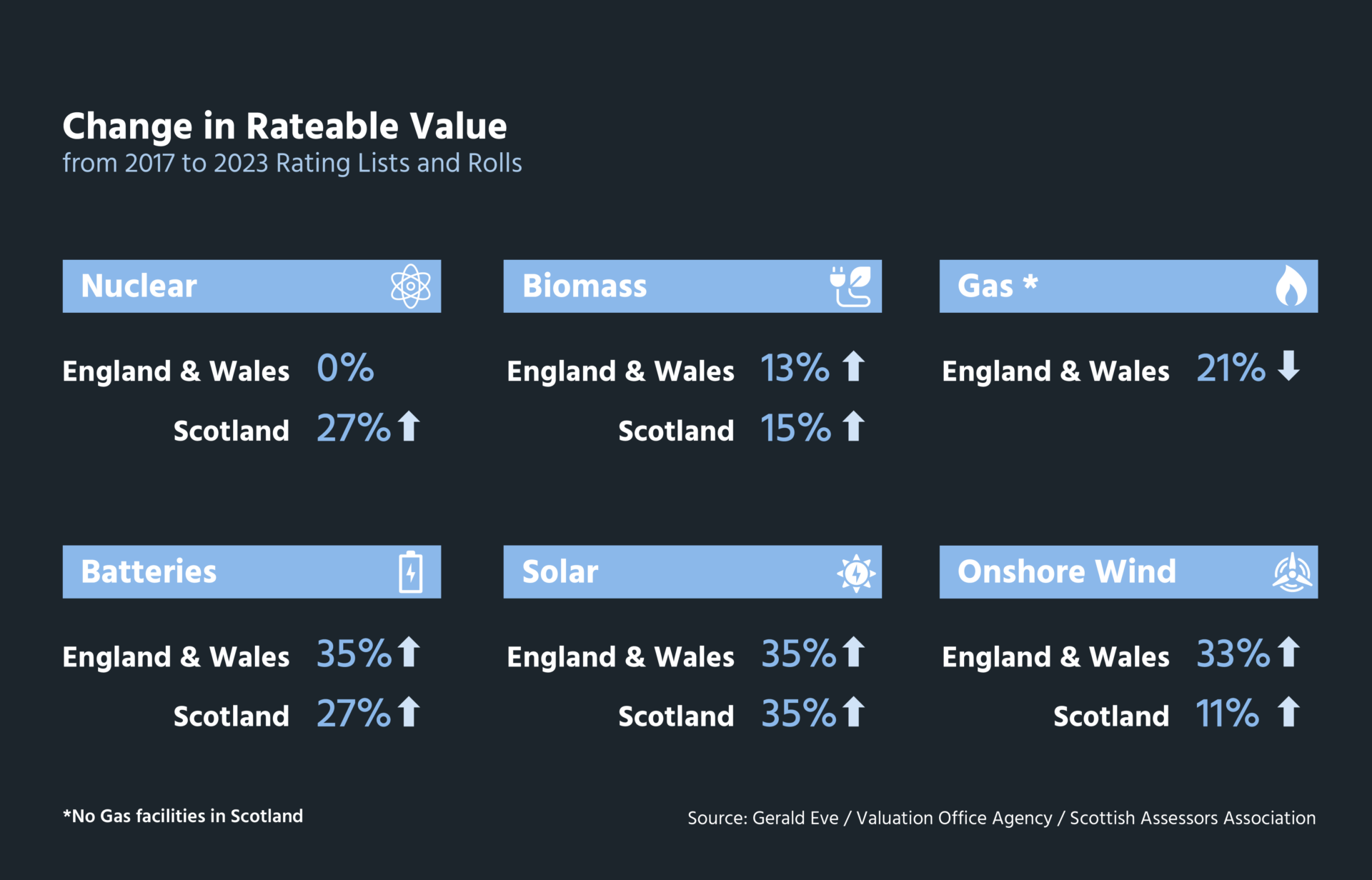

Impact of Revaluation 2023 on Energy and Renewables

Low carbon, particularly renewable technologies, have seen material increases in assessment and liability since April 2023. There are reasons underlying this but also key issues which remain outstanding and may serve to reduce your liability with the best advice and appropriate action.

Valuation Date

The valuation date for businesses rates fell on 1 April 2021 in England and Wales, 1 April 2022 in Scotland and 1 October 2021 in Northern Ireland. Valuations reflect the wholesale energy price at these dates. Fortunately for sites in England and Wales the surge in wholesale prices was not foreseen in April 2021 but was starting to emerge by October 2021 in Northern Ireland and had become more embedded by April 2022 in Scotland, resulting in differences to levels of value applied in the different areas.

Outputs

Sites which achieve higher outputs through strong load factors will see higher business rates liabilities, as this is explicitly reflected in the valuations. This is one of the key points to review, as many sites will be assessed on an estimate of achievable output, which should be tested against actual outputs. Temporary and permanent constraints can also be relevant issues for reducing liabilities where applicable.

Unsupported Assets

The highest liabilities will apply to assets with historical fiscal support mechanisms which drive revenues. In contrast, more recently constructed unsupported solar and wind assets should see lower liabilities on the 2023 Rating List. Assets falling out of support prior to a revaluation should also see liability reductions.

Regulatory compliance

England and Wales

Non-Domestic Rating Act 2023

The Non-Domestic Rating Act 2023 will introduce potentially onerous mandatory obligations on ratepayers to regularly update the tenure and physical details of all properties within their portfolios with the Valuations Office Agency (VOA).

Increasing the administrative burden on businesses, it will require prompt updates to the VOA and annual returns even where there are no changes, with penalty risks for non-compliance. The complexity of business rates management will increase with measures anticipated to be fully in place for the 2026 Revaluation.

Material Change of Circumstance (MCC)

Legislative changes to Material Change of Circumstance provisions took immediate effect in October 2023. They tighten the scope of MCCs in England so that new legislation, licensing regimes and guidance from public bodies will not be grounds for a change in Rateable Value between revaluations.

Completion Notices

For buildings that have been temporarily removed from the rating list during redevelopment, billing authorities will be able to issue Completion Notices in the same way as for a new building. The regulatory changes should be in effect from January 2024.

Scotland

Since January 2023, Scotland’s new legislation has transferred Valuation Appeals to the Scottish Courts Tribunal service. This entails strict deadlines and rigorous requirements for ratepayers and advisors. All appeals against valuations from April 2023 should have been submitted as a comprehensive case with supporting data by 31 August 2023. Learn more about how to appeal business rates in Scotland >

How we can help

Our team of experts, specialising in energy and renewables business rates, brings together vast experience and deep industry insight. Our goal is to help you identify potential cost-saving measures in your business rates, allowing you to allocate your capital where it matters most.

-

Review and Appeal

We know when to appeal and when to leave well alone. Our experience across a diverse range of generation storage and distribution assets gives us a real edge in our negotiations. This insight and our forensic attention to detail translates into successful appeal and mitigation strategies.

-

Budgeting and Forecasting

Our budgetary advice allows clients to understand their current and future liabilities on existing and new sites as well as new technologies. Our financial forecasts can be high level and more detailed as required and are regularly updated to reflect changes in budgetary assumptions resulting from government announcements and pending revaluations. This ensures that investment decisions are made on sound budgeting advice.

-

Pre-Agreements and Changes

We pride ourselves on a strong working relationship with the Valuation Office Agency, Scottish Assessors and Land & Property Services and take a proactive approach to engaging with them. Our clients benefit from our ability to pre-agree new assessments in advance of a revaluation, or when a new property is commissioned, which removes the need for appeal discussions and costs, and provides budgetary certainty.

This relationship also assists when dealing with physical changes to sites or changes in generation levels where assessments can be reduced.

-

Exemptions and Reliefs

Regular communication with our clients allows us to identify and pursue more opportunities for achieving rates savings through reliefs and reductions for temporary outages and constraints on generation. We are experienced in dealing with the different reliefs and exemptions available across England, Wales, Scotland and Northern Ireland, including empty rates, partially occupied relief, Small Business Rates Relief, reliefs available in Enterprise Zones, Investment Zones and Freeports, and business rates growth accelerator.

Legislation in England has proposed to introduce improvement relief and has already introduced heat network relief and support on-site generation through lower business rates. In Wales, onsite generation relief is anticipated to be in place from 1 April 2024. In Scotland, when launched, onsite generation relief is anticipated to be backdated to 1 April 2023.

-

Historic Rates Audit

Our historic rates audit ensures that past errors and overpayments are resolved and refunded.

-

Rates Payment Management Service (RPMS)

We provide a fully outsourced rates payment service with regular client reporting, removing an administrative burden and ensuring complete accuracy of payments and guaranteeing all refunds and reliefs are claimed.

Case studies

-

UK Solar Portfolio

On behalf of a major investor and asset manager of renewable assets in the UK, we generated over £1.2m in savings across the 2017 Rating Revaluation. A comprehensive review of the UK solar portfolio was undertaken, and bespoke actions agreed across a high proportion of sites. This yielded material savings to the client. Detailed and thorough savings reporting was required, given the complexity of the interlinking actions and the number of sites.

UK Solar Portfolio -

Biomass Power Stations

We were instructed by an investor, developer and long-term fund manager of energy assets in the UK and Europe to review the assessments of two biomass sites, one in Sheffield and one in Nottingham. Site visits and a review of financial accounts with the finance manager enabled us to assess the level of business rates valuations. We identified errors in both valuations and acted to yield backdated refunds of over £400,000 across both sites.

Biomass Power Stations -

Wind Farm

A wind farm operator of a 25MW facility asked us for advice regarding their 2017 List assessment. We guided them in challenging a previous Rating List by asking the Valuation Office to issue a Certificate. This Certificate would decrease the amount they needed to pay under the government's transitional relief rules. The Valuation Office agreed with this approach, saving the client nearly £500,000 over the life of the 2017 Rating List, of which £300,000 was received immediately.

Wind Farm -

Hydro Electric Power Station

Our client, one of Europe’s largest generators of renewable energy, experienced a doubling of the Rateable Value of their 56MW hydroelectric power station in Wales from the 2010 to the 2017 Revaluation. We reviewed the assessment with the client and proactively engaged with the Valuation Officer. A thorough review of the valuation inputs was undertaken, and as a result, a £220,000 reduction in Rateable Value was negotiated. This saved the client over £500,000 over the life of the 2017 Revaluation.

Hydro Electric Power Station

Our clients

Some of the clients we work with.

Key Facts

£9.3bn

total Rateable Value handled

£1.3bn

client savings since 2017, £3.8 bn since 2010

£25%

of the FTSE represented

£1bn

rate liability processed each year as UK's leading outsourced ratepayer

Revaluation 2023

Many businesses may have an opportunity to reduce their business rates liability. Are you one of them?

Learn MoreNEWS AND INSIGHTS

View All InsightsRating Update – Welsh Budget 2025/26 UBRs and Reliefs

2 weeks ago 3 Mins ReadRating Update – Scottish Budget 2025/26 UBRs and Reliefs

3 weeks ago 5 Mins ReadBusiness Rates for the leisure industry: what lies ahead?

3 weeks ago 3 Mins ReadCookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |