Fuels and Decarbonisation Business Rates

Navigating the complex

Business rates can be among the top five outgoings for sites in the fuels, decarbonisation and sustainable chemicals sectors. With the rising costs of power, natural gas, labour, and maintenance, now more than ever it’s important to find effective solutions to manage your rates liability.

Our team of business rates experts has deep sector knowledge of the regulatory and market changes impacting the use and financial performance of these key assets to the UK economy. This market expertise ensures that we provide you with the best advice to budget for major new projects required to decarbonise the sector, such as carbon capture and e-fuel production, and take all proactive action to mitigate your business rates liability on existing assets. Our experts use a proven valuation approach to help you manage your rates liability throughout the asset life cycle.

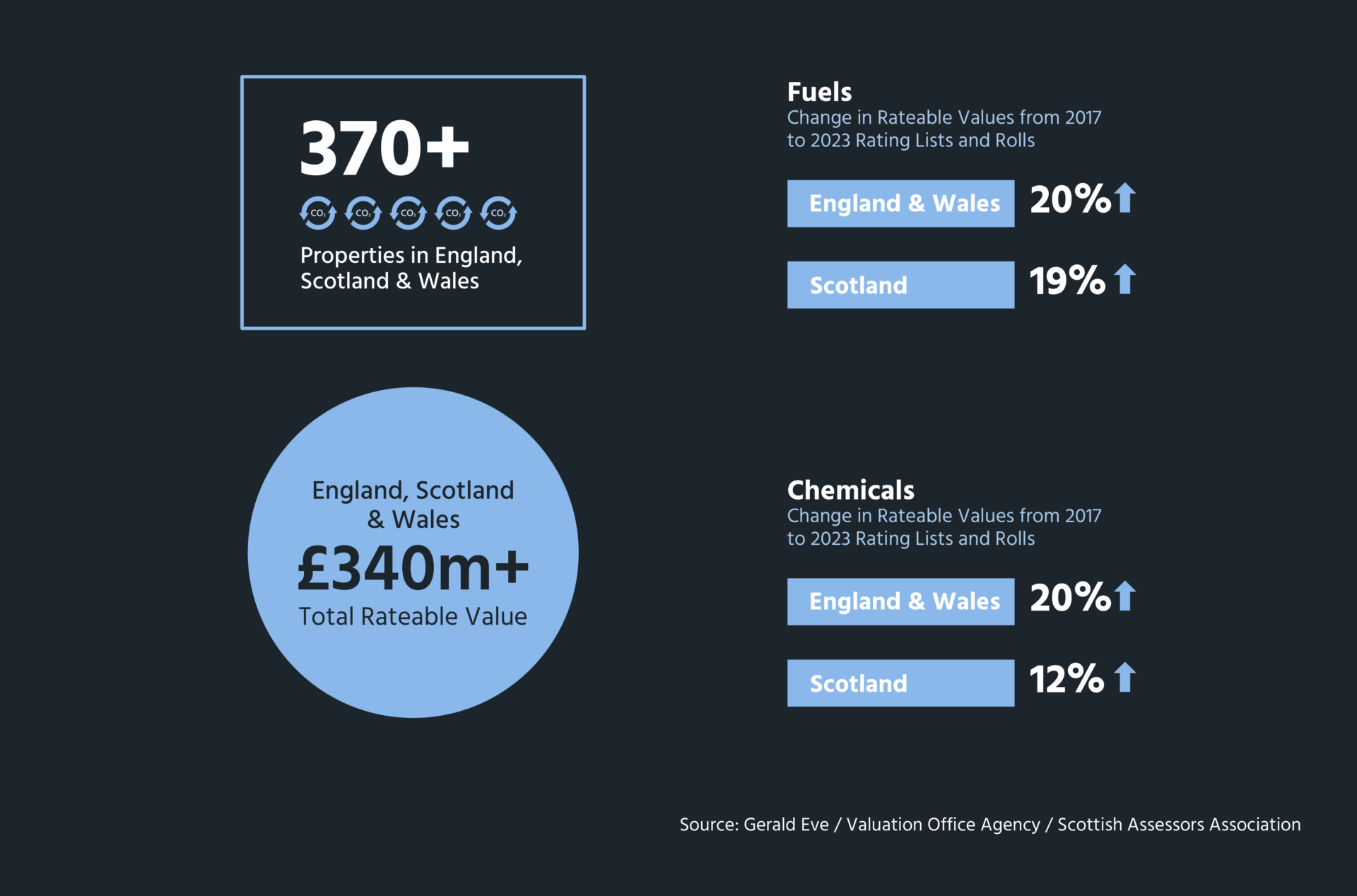

Impact of Revaluation 2023 on Fuels and Decarbonisation sector

The 2023 Revaluation is a result of significant changes across this sector.

Valuation Date

The valuation date for businesses rates fell on 1 April 2021 in England and Wales and 1 April 2022 in Scotland. Valuations reflect the construction costs at these dates.

There were several factors prevalent at the valuation date which might support a mitigation in business rates assessment and annual liability, such as the impact of the COVID-19 pandemic, the global competition impacting margins and the impact of high energy, carbon, and raw material costs.

Fuel and sustainable chemical outputs

Modern sites will have seen increases of Rateable Values at the upper end of the range while older plants will have seen more limited increases due to the increases in age allowances. The replacement cost valuation methodology allows for a review of financial performance which should be reflected within the valuation. In many cases the Valuation Office or Scottish Assessor will not have fully reflected some of the factors impacting on a site’s financial performance.

Decarbonisation projects

To decarbonise the fuels and sustainable chemicals sector and support the UK achieving net zero major capital expenditure is required on projects including:

- Carbon Capture and Storage

- Green and Blue Hydrogen production, transport, and storage

- E-fuel production and storage

- Liquid Ammonia production

- “Green” Steel Production

Business rates will be a material costs associated with projects of this nature. Key areas of focus should be:

- initial high-level budgeting and more detailed budgeting to support final investment decisions

- project design and layout to mitigate business liability

- political lobbying to change the business rates system to incentivise investment in decarbonisation projects

- regulatory changes which may impact on business rates liability

Regulatory compliance

England and Wales

Non-Domestic Rating Act 2023

The Non-Domestic Rating Act 2023 will introduce potentially onerous mandatory obligations on ratepayers to regularly update the tenure and physical details of all properties within their portfolios with the Valuations Office Agency (VOA).

Increasing the administrative burden on businesses, it will require prompt updates to the VOA and annual returns even where there are no changes, with penalty risks for non-compliance. The complexity of business rates management will increase with measures anticipated to be fully in place for the 2026 Revaluation.

Material Change of Circumstance (MCC)

Legislative changes to Material Change of Circumstance provisions took immediate effect in October 2023. They tighten the scope of MCCs in England so that new legislation, licensing regimes and guidance from public bodies will not be grounds for a change in Rateable Value between revaluations.

Completion Notices

For buildings that have been temporarily removed from the rating list during redevelopment, billing authorities will be able to issue Completion Notices in the same way as for a new building. The regulatory changes should be in effect from January 2024.

Scotland

Since January 2023, Scotland’s new legislation has transferred Valuation Appeals to the Scottish Courts Tribunal service. This entails strict deadlines and rigorous requirements for ratepayers and advisors. All appeals against valuations from April 2023 should have been submitted as a comprehensive case with supporting data by 31 August 2023. Learn more about how to appeal business rates in Scotland >

How we can help

Our team of experts, specialising in fuels and decarbonisation business rates, brings together vast experience and deep industry insight. Our goal is to help you identify potential cost-saving measures in your business rates, allowing you to allocate your capital where it matters most.

-

Review and Appeal

We know when to appeal and when to leave well alone. Our experience across a diverse range of assets gives us a real edge in our negotiations. This insight and our forensic attention to detail translates into successful appeal and mitigation strategies.

-

Budgeting and Forecasting

Our budgetary advice allows clients to understand their future liabilities on existing and new sites as well as modern technologies. Major projects such as carbon capture and e-fuels will have material business rates implications. Our financial forecasts are regularly updated to reflect changes in budgetary assumptions resulting from government announcements and pending revaluations. This ensures that investment decisions are made on sound budgeting advice.

-

Pre-Agreements and Changes

We pride ourselves on a strong working relationship with the Valuation Office Agency and Scottish Assessors and we take a proactive approach in engaging with them. Our clients benefit from our ability to pre-agree new assessments which removes the need for appeal discussions and provides budgetary certainty. This relationship also assists when dealing with physical changes to sites or changes in generation levels where assessments can be reduced.

-

Exemptions and Reliefs

Regular communication with our clients allows us to identify and pursue more opportunities for achieving rates savings through pursing reliefs and reductions for temporary outages and constraint on generation. We are experienced in dealing with the different reliefs and exemptions available across England, Wales and Scotland including empty rates, partially occupied relief, small business rates relief and the business rates growth accelerator. Recent legislation in England proposes to introduce improvement relief and heat network relief as well as support on site generation through lower business rates.

-

Historic Rates Audit

Our historic rates audit ensures that past errors and overpayments are resolved and refunded.

-

Rates Payment Management Service (RPMS)

We offer the market leading rate payment management service to ensure you only ever pay the correct rates liability.

Case studies

-

Fuels Refinery

On behalf of a major refinery operator, we pursued an appeal to the Upper Tribunal to reflect the weak refinery economics on the 2010 Rating List, resulting in a financial saving to the client of approximately £5 million. We pursued further appeals on the 2017 List to reflect the fact that the refinery had moved to a single distillation configuration resulting in the deletion of the decommissioned units and a saving of approximately £400,000.

Fuels Refinery -

Gas Storage Facility

We pursued an appeal to Valuation Tribunal on a gas storage facility developed from a depleted onshore production facility. We successfully challenged the valuation method arguing that Receipts and Expenditure (profits) approach was the correct approach to reflect the economics of the site operation. Our arguments resulted in a multi-million pound saving for our client.

Gas Storage Facility -

Pipeline

We advised a British multinational fuels company in respect of seeking a business rates reduction reflecting the permanent closure of an ethylene plant and subsequent material reduction in utilisation of a cross-country pipeline, between the Northwest of England and Scotland. We successfully pursued appeals with the Valuation Office Agency and negotiated the deletion of the ethylene plant and agreed the adoption of a significant allowance within the contractor’s basis pipeline valuation, resulting in savings more than £12 million on the 2017 rating list.

Pipeline -

Fuels Tank Farm

Our clients operated a fuels farm which had been repurposed from historic refining operations. Using our in-depth sector knowledge and leveraging long standing and close client relationships, we successfully gave evidence at the Upper Tribunal, demonstrating that a modern equivalent facility would have been configured with a more efficient layout and materially lower operating costs and that these matters should properly be reflected in the rating valuation. Our work successfully delivered savings in excess of £3.2m.

Fuels Tank Farm

Key facts

£9.3bn

total Rateable Value handled

£1.3bn

client savings since 2017, £3.8 bn since 2010

25%

of the FTSE represented

£1bn

rate liability processed each year as UK's leading outsourced ratepayer

News and Insights

Read MoreRating Update – Welsh Budget 2025/26 UBRs and Reliefs

2 weeks ago 3 Mins ReadRating Update – Scottish Budget 2025/26 UBRs and Reliefs

3 weeks ago 5 Mins ReadBusiness Rates for the leisure industry: what lies ahead?

3 weeks ago 3 Mins ReadCookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |