Leisure Business Rates

Pay the correct business rates

At a time when the leisure operators remain focussed on recovery, alongside the myriad of other more recent cost pressures, it is critical that rating assessments properly reflect the impact of both the depth and duration of the pandemic on each sub-sector. If you own or operate a business in the leisure sector, having a solid understanding of how your business rates work is crucial to effectively manage costs and maximising profitability. Our flexible business rates service is tailored to your specific requirements and is designed to save you time and money.

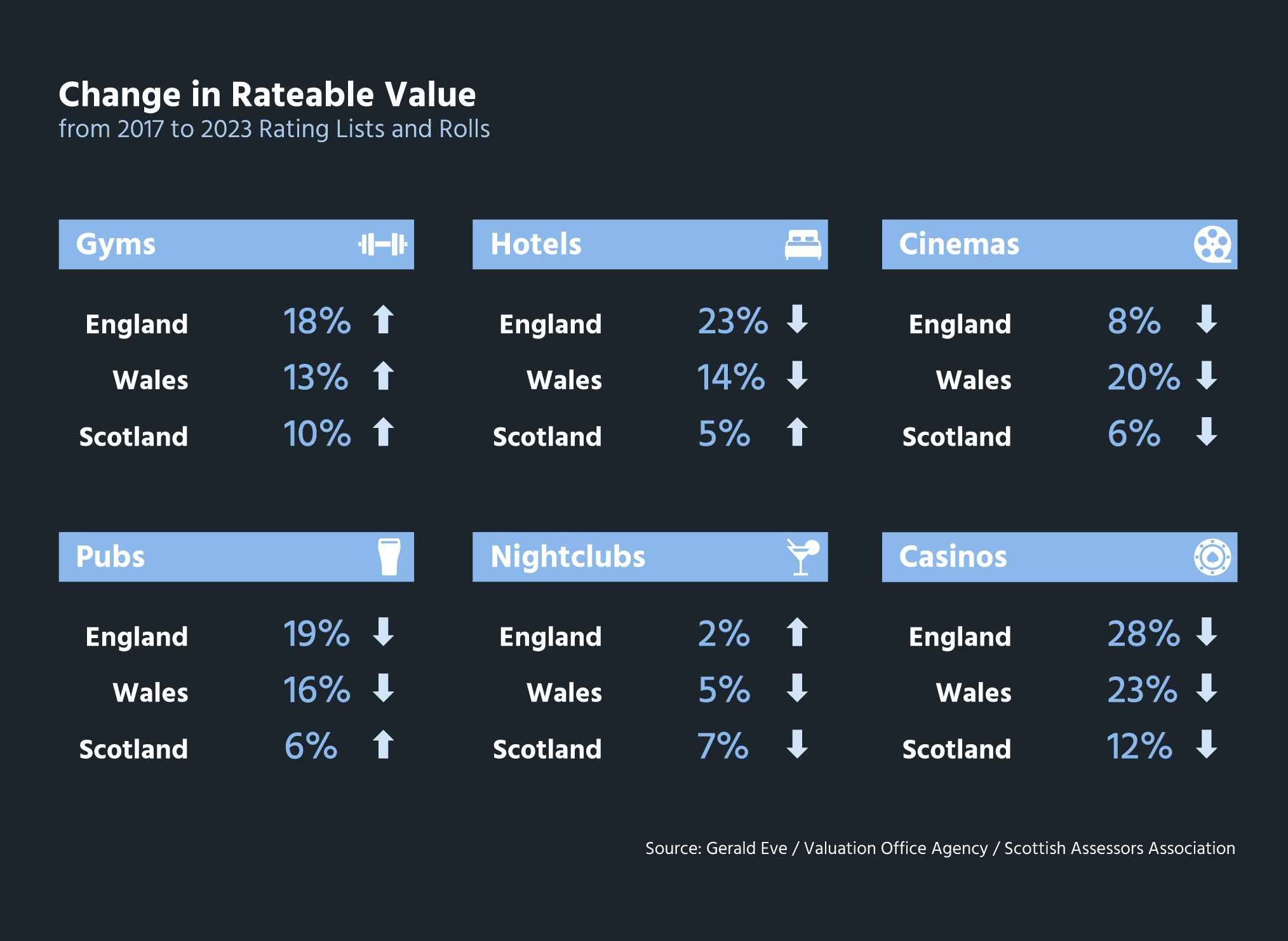

Impact of Revaluation 2023 on Leisure

The leisure sector was hit particularly hard by the restrictions imposed by the pandemic, with the cuts experienced going deeper and lasting longer than for many other parts of the economy. Fast forward to 2023 and, while for many trading metrics are returning to pre-pandemic levels, the recovery of profit is more complex. While 2023 Rateable Values saw a decrease, for many there is scope for review. Here, we delve deeper into what is shaping business rates in the leisure industry.

The market has changed

The 2023 Revaluation came at a particularly sensitive time for leisure businesses and provided an opportunity for Rateable Values to be recalibrated to properly reflect market changes since the last revaluation.

For leisure ratepayers, this was arguably the most important rating revaluation for more than 20 years. It was also probably the most challenging from a valuation perspective, given both the ebbs and flows of trading performance since the last revaluation in 2017 and comparatively little market evidence since 2020.

For many leisure businesses, operational characteristics form an inherent part of the calculation of Rateable Value.

The challenges and the opportunities

Leisure operators are currently grappling with several challenges:

- A recruitment crisis has been limiting their ability to operate as frequently or for as long as desired.

- The cost-of-living crisis is putting a strain on discretionary income, leading consumers to cut back on entertainment spending.

- Changing consumer and workplace habits are impacting the profitability of venues in city centres.

Among others, these combined factors threaten the sustainability and profitability of businesses in the leisure sector.

There are however opportunities to offset the challenges . Leisure operators can access the Retail Hospitality Leisure Relief Scheme. However, legislation is changing frequently, and advice can assist.

Removal of downwards transitional relief improves the prospects of generating real rates savings.

Trade-based valuations from the 2021 Antecedent Valuation Date (AVD) may offer scope for reductions, providing some financial relief.

Further, potential savings may be derived from Material Change of Circumstances (MCCs), such as disturbances near a property or new competition in the catchment.

Regulatory compliance

England and Wales

Non-Domestic Rating Act 2023

The Non-Domestic Rating Act 2023 will introduce potentially onerous mandatory obligations on ratepayers to regularly update the tenure, trading and physical details of all properties within their portfolios with the Valuations Office Agency (VOA).

Increasing the administrative burden on businesses, it will require prompt updates to the VOA and annual returns even where there are no changes, with penalty risks for non-compliance. The complexity of business rates management will increase with measures anticipated to be fully in place for the 2026 Revaluation.

Material Change of Circumstances (MCC)

Legislative changes to Material Change of Circumstances provisions took immediate effect in October 2023. They tighten the scope of MCCs in England so that new legislation, licensing regimes and guidance from public bodies will not be grounds for a change in Rateable Value between revaluations.

Completion Notices

For buildings that have been temporarily removed from the rating list during redevelopment, billing authorities will be able to issue Completion Notices in the same way as for a new building. The regulatory changes should be in effect from January 2024.

Scotland

Since January 2023, Scotland’s new legislation has transferred Valuation Appeals to the Scottish Courts Tribunal service. This entails strict deadlines and rigorous requirements for ratepayers and advisors. All appeals against valuations from April 2023 should have been submitted as a comprehensive case with supporting data by 31 August 2023. Learn more about how to appeal business rates in Scotland >

Who we work with

Each of these leisure sub-sectors has its own unique features, market dynamics, and trading styles, making the industry a diverse and multifaceted field for managing and mitigating business rates.

Accommodation

From hotels, serviced apartments, resorts, caravan parks, seaside retreats and other accommodation to standalone conference centres and those located within hotels.

Amusement parks and arcades

Amusement parks, theme parks, water parks, arcades, zoos, parks and similar attractions offering rides, games, and other entertainment.

Arts and entertainment

From theatres, cinemas, concert halls, and art galleries to businesses involved in entertainment and live performances.

Gaming and gambling

From casinos and online gambling platforms to those involved in lottery or other betting activities.

Heritage and culture

From museums, manor houses and cultural centres to archaeological and historic sites.

Hospitality

From pubs and bars to nightclubs.

Recreation and sports

From indoor businesses like sports clubs, climbing walls, padel tennis, swimming pools to outdoor recreational businesses like adventure courses.

Health clubs and gyms

Gyms, health clubs as well as personal care services such as spas, massage centres, and wellness retreats.

Big box leisure

Trampoline parks, soft play centres, go-karts, indoor golf, escape rooms, bowling alleys and climbing centres.

How we can help

Our specialists in leisure business rates blend deep experience with sector-specific insight. Harnessing market-leading data, we deliver impactful outcomes for clients. Discover how our team can guide you through the complex world of business rates.

-

Complementary Health check

We will always provide an initial review of your rates position. This allows us to identify risks, opportunities and ensures you are happy to proceed fully aware of what to expect when it comes to understanding business rates.

-

Review and Appeal

When your Rateable Value looks excessive, we review and start the initial process of appealing your assessment. This review includes several methods used to ensure you always pay the correct business rates bill.

-

Budgeting and Forecasting

Budgeting and forecasting are integral to your cashflow and business. We provide you up-to-date forecasting and budgeting advice to keep you on track of your risk and exposure at any given time.

-

Disturbances and Deletions

Undergoing building works to your property? We aim to reduce your rates during the duration of any works you carry out. If you find yourself next to a building site, road works, scaffolding over your property or any other disturbance, we aim to secure a reduction in your rates during the length of the works.

-

Vacant Properties

Vacant property can be expensive to run and difficult to maintain and secure. We advise and manage empty rates mitigations schemes for you. We advise you on the best way to mitigate your rates liability depending on your circumstances and goals.

-

Exemptions and Reliefs

Properties are entitled to different exemptions and relief based on certain criteria. Reliefs and exemptions can be difficult to navigate and understand. We make understanding your entitlements easier by reviewing each of your properties to ensure you receive your relief and exemptions, if applicable.

-

Historic Rates Audit

Our historic rates audit ensures that past errors and overpayments are resolved and refunded in a timely manner. We also meticulously track and trace any properties you have disposed of to see if you are owed any refunds.

-

Rates Payment Management Service (RPMS)

We remove the hassle of multiple payments across all of your properties. We provide you with one monthly payment request; we then take care of the rest paying individual councils on your behalf. This minimises errors, enforcements and bailiff actions.

Case studies

-

Bar, Pub and Restaurant

The ETM Group opened a bar/restaurant in Canary Wharf but found the rates burden to be excessive. We established that there were four potential avenues to pursue in seeking a reduction in Rateable Value – the adopted main space rate, the relative value on first floor trading area, the treatment of ancillary areas for valuation and the correct date for the assessment to be effective. We undertook thorough investigations into the framework of rental evidence including detailed inspection of the entire Canary Wharf eating and drinking destination. We applied our extensive knowledge of the Canary Wharf bar rental market. We approached the Valuation Office Agency (VOA) to explain that their assessment was excessive. The VOA did not agree which eventually led to the case being heard at Valuation Tribunal. The Tribunal determined that the assessment should be reduced by just under 13%. The decision was awarded with an amended effective date, with the above all leading to significant rates savings for our client.

ETM Group -

Fitness Centres

We have acted for the Gym Group for two rating lists. We currently handle all of their rating matters across their entire estate. Our work includes managing checks and challenges, handling all rates payments and pre-agreeing new assessments which need to be assessed. The Gym Group opened a new gymnasium in Northampton. There was no rating assessment in the 2017 Rating List. We inspected and measured the property and approached the Valuation Office Agency with the intention of pre-agreeing the assessment. We were able to pre-agree the new assessment giving certainty for budgeting.

Gym Group -

Hotel and pub operator

We act for Whitbread who is one of our longest standing business rates clients. Whitbread operate under a range of brand formats covering hotels and public houses. We have saved Whitbread a significant amount in the 2017 Rating List through pre-agreements, checks and challenges. We manage and pay all of their business rates bills through our Rates Payment Management Services. This ensures that no bills are missed and that bills are paid on time which can be challenging for a rate payer with multiple properties.

Whitbread

Why us?

We are leisure sector specialists.

Partner-led

Our clients benefit from a dedicated client partner, overseeing all aspects of our services. We can offer a full-service or a specific advisory service to fit around your needs. We go to extraordinary lengths to ensure our experienced professionals are fully aligned to your requirements.

Trusted experts

Our primary focus is on developing a long-term, trusted adviser relationship, where your priorities come above everything else. We act as your eyes and ears in the market and arrange regular review meetings to understand your future commercial priorities and how we can help achieve them.

Knowledge

We regularly share market insights and host events on current trends, legislative updates and other important topics.

Our clients

Some of the clients we work with.

Key Facts

£9.3bn

total Rateable Value handled

£1.3bn

client savings since 2017, £3.8 bn since 2010

25%

of the FTSE represented

£1bn

rate liability processed each year as UK's leading outsourced ratepayer

Key contacts

Revaluation 2023

Many businesses may have an opportunity to reduce their business rates liability. Are you one of them?

Learn MoreNews and insights

Rating Update – Welsh Budget 2025/26 UBRs and Reliefs

1 month ago 3 Mins ReadRating Update – Scottish Budget 2025/26 UBRs and Reliefs

2 months ago 5 Mins ReadBusiness Rates for the leisure industry: what lies ahead?

2 months ago 3 Mins ReadCookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |