Office business rates

Pay the correct business rates

The way we use offices has changed. The effects of COVID-19 and remote working mean that the value of offices has shifted. With the unprecedented changes in the office sector, both landlords and occupiers face increasing costs and complexity in managing business rates.

Our team of business rates specialists is committed to helping you overcome the intricacies to ensure that you pay rates that are fair and precise. Our extensive expertise in the sector enables us to assess property valuations and identify potential savings and exemptions accurately.

Impact of Revaluation 2023 on offices business rates

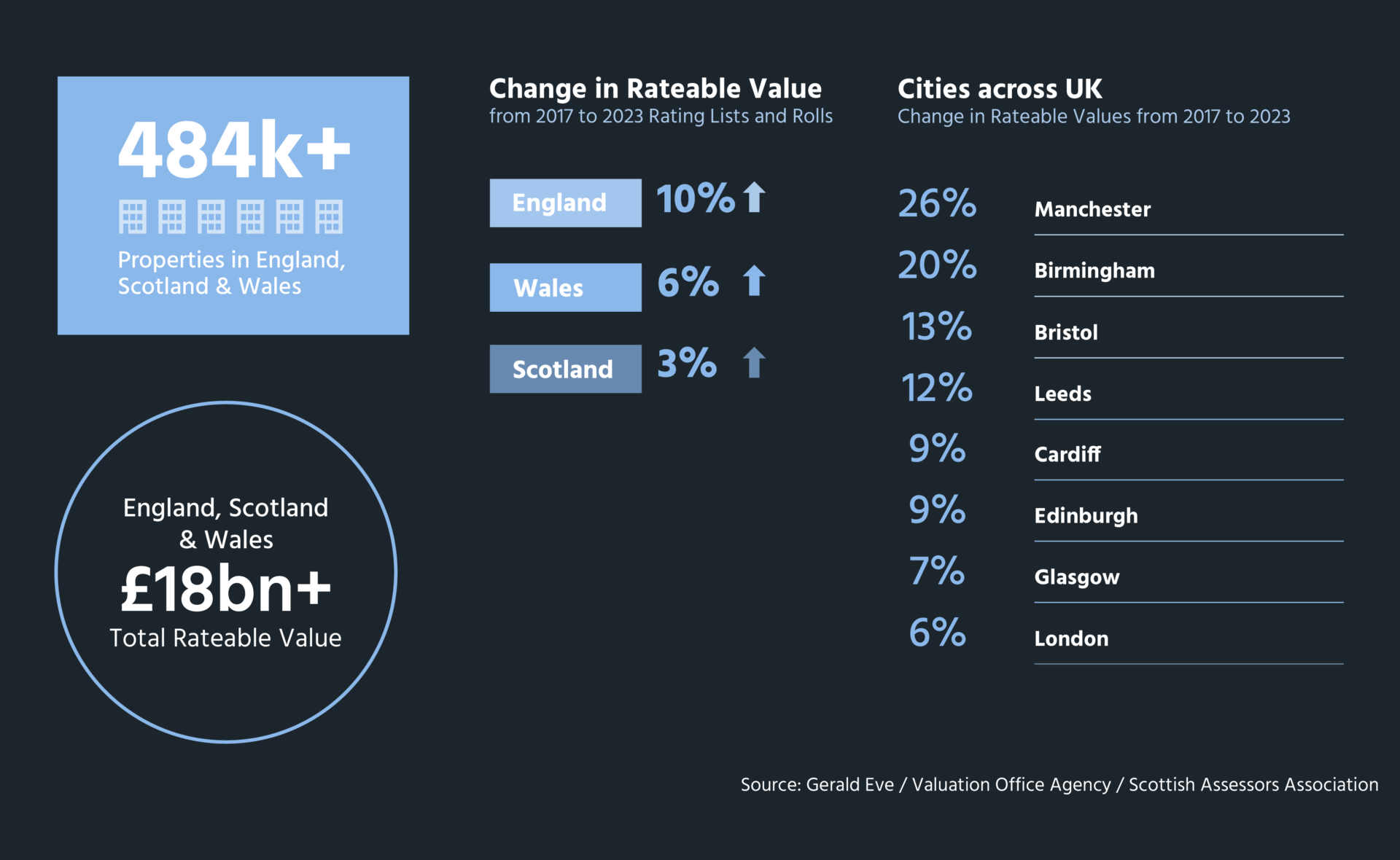

The COVID-19 pandemic brought about a significant shift in the way people work, and limited office transactions at a time of uncertainty, leading to fluctuations in office rental values. Our analysis shows that there were significant variations between the 2017 and 2023 Rating lists and rolls. The offices sector had an average 6.4% increase in Rateable Values across England, Scotland, and Wales, with specific locations varying considerably. For instance, office values in Watford increased by over 60%, and prime offices in Leeds saw their values rise by 25-30%. With the changing dynamics within the sector, there is an opportunity to check whether the values assigned are correct.

Flight to quality

A trend accelerated by the Pandemic has meant that increasingly traditional office spaces are no longer as desirable, so landlords have to adapt to attract tenants. Occupiers are seeking collaborative spaces, green spaces, and offices that reflect their brand identity. Hybrid working has also led to a reduction in the size requirements for office spaces. This ‘flight to quality’ means that occupiers are looking for smaller, higher-quality spaces. With each property being unique, Rateable Values need to be reviewed to ensure accuracy for the 2023 Rating lists and rolls. With the ‘flight to quality’, the secondary and tertiary spaces have quickly become undesirable, and their values are falling. If Valuation Officers and Scottish Assessors have been unable to review each of these unique properties, occupiers should take the initiative to do so themselves.

Empty property

Landlords are facing significant challenges with secondary space, leaving them with the choice of redeveloping or leaving their properties empty. This places a heavy burden on landlords, investors, and developers, who are required to pay full empty rate liability after the initial relief period, with no tenancy in place. However, for those who choose to redevelop or refurbish their properties, there is an opportunity to remove assessments and liability from the rating list entirely during the construction phase. With rates being one of the biggest overheads for landlords, the savings can be substantial.

Sustainability

The Minimum Energy Efficiency Standards (MEES) and Energy Performance Certificate (EPC) regulations are having a significant impact on the office property sector, felt by both landlords and tenants. This increasing focus on sustainability means that sustainable additions to buildings will eventually become rateable. This will likely result in increased costs for occupiers in the long run. However, there may be an incentive to make sustainable additions now before they become rateable. While there could be an argument in the future around ‘beneficial occupation’ and the requirements for efficiency, from a rating perspective, the long-term benefits of sustainability measures will likely outweigh the added cost.

Regulatory compliance

England and Wales

Non-Domestic Rating Act 2023

The Non-Domestic Rating Act 2023 will introduce potentially onerous mandatory obligations on ratepayers to regularly update the tenure and physical details of all properties within their portfolios with the Valuations Office Agency (VOA).

Increasing the administrative burden on businesses, it will require prompt updates to the VOA and annual returns even where there are no changes, with penalty risks for non-compliance. The complexity of business rates management will increase with measures anticipated to be fully in place for the 2026 Revaluation.

Material Change of Circumstance (MCC)

Legislative changes to Material Change of Circumstance provisions took immediate effect in October 2023. They tighten the scope of MCCs in England so that new legislation, licensing regimes and guidance from public bodies will not be grounds for a change in Rateable Value between revaluations.

Completion Notices

For buildings that have been temporarily removed from the rating list during redevelopment, billing authorities will be able to issue Completion Notices in the same way as for a new building. The regulatory changes should be in effect from January 2024.

Empty Rate Relief

The Business Rates Avoidance and Evasion Consultation closed at the end of September. The consultation document covered various forms of empty rate mitigation, which central and local governments are seeking to remove or limit, and it sought views on how reforms should be implemented. Measures under consideration include:

- Extending the period during which properties need to be reoccupied before a period of empty rate relief can be claimed from the current six weeks to three or six months

- Limiting the number of times that an individual ratepayer might be able to apply for empty rate relief on the same property

- Requiring more than 50% of a property’s floorspace to be occupied to qualify for a fresh rates-free

Scotland

Since January 2023, Scotland’s new legislation has transferred Valuation Appeals to the Scottish Courts Tribunal service. This entails strict deadlines and rigorous requirements for ratepayers and advisors. All appeals against valuations from April 2023 should have been submitted as a comprehensive case with supporting data by 31 August 2023. Learn more about how to appeal business rates in Scotland >

How we can help

Our team of specialists in office business rates possesses extensive experience and expertise in the industry. Along with our state-of-the-art market data, we work towards delivering effective outcomes for our clients. Discover how our team can assist you in navigating the intricacies of business rates.

-

Review and Appeal

We know when to appeal and when to leave well alone. Our experience of a diverse range of properties and locations across the UK gives us a tangible edge in our negotiations. This insight and our forensic attention to detail translate into successful appeal strategies.

-

Serviced/Flexible Offices

We are one of the leading specialists in business rates for serviced offices, an increasing proportion of the offices market. We focus on harnessing small business rates relief, empty rates relief and managing rates payment services for both our occupier and landlord clients.

-

Budgeting and Forecasting

We can provide certainty with the accuracy of rate bills and account for future new builds and other changes in your accrual reports, which are crucial when budgeting for new sites and capital investments.

-

Disturbances and Deletions

As well as advising on the impact of physical changes, including demolitions and temporary disturbances, we also work closely with the Valuation Office Agency and Scottish Assessors Association to manage and, where possible, ‘prior-agree’ alterations to assessments to reflect these changes.

-

Vacant Properties

Whether your property is empty, mothballed, to be refurbished or redeveloped, we advise on and manage the removal of assessments from the very beginning of the strip-out process. Major changes are expected to this area of business rates in terms of relief available and it is therefore vital you are aware of the latest opportunities to save money.

-

Exemptions and Reliefs

We are at the forefront of devising innovative strategic solutions to problems posed by changes to legislation. We ensure all available and applicable reliefs are properly applied.

-

Plant and Machinery

With buildings such as data centres or disaster recovery spaces, plant and machinery can form a significant part of the rating assessment. We can provide a detailed review of the assets valued and whether they are correctly included. This is a highly specialised area of business rates with complex regulations determining the rateability of plant and machinery. Our experts deal with some of the most complex facilities in the UK and have led in developing case law within this area.

-

Offices and Council Tax

As residential use can sometimes form part of a historic or converted property, this can incur Council Tax bills, which we manage or resolve through the Council Tax teams at Local Authorities and the Valuation Office.

-

Rates Payment Management Service (RPMS)

We offer the market-leading rate payment management service to ensure you only ever pay the correct rates liability.

Case studies

-

Office Headquarters

Working of behalf of a multinational financial services firm, we reviewed the 2017 valuation of their huge office headquarters in Glasgow. On review of the valuation, we identified that the Scottish Assessor had made individual entries for each floor in the valuation roll. Our client was the sole occupier of the property, and we challenged the valuation approach adopted by the Assessor, outlining key principles and our clients occupation. Our negotiations prompted the Assessor to amend and make a single entry in the valuation roll. As a single entry, the property now attracted a quantum allowance in the valuation, which we negotiated with the Assessor to secure. Savings to the client were approximately £500,000.

Unit of valuation -

Financial Institution

Advising a large financial sector client occupying 70,000 sq ft in the City of London, we secured substantial savings through separate appeals and claims. Firstly, we secured a reduction in the base value applied from 1 April 2017 through detailed analysis of rental evidence and submission of Checks and Challenges. During the phased refurbishment of the floors, we successfully applied to the billing authority for empty rates relief. When the client reoccupied all floors, we achieved additional valuation savings by merging the four floors and applying a quantum discount. Later in the List, we submitted an appeal due to adjacent demolition and redevelopment works, causing physical disturbance and loss of amenity, and negotiated a temporary discount over a four-year period. Finally, when all floors were again vacated, we ensured our client benefitted from void rates relief. Overall, we secured savings for our client of over £900,000.

Changing circumstances -

Landed Estate

A private landlord instructed us to provide rating advice on a major redevelopment scheme in the West End. This involved providing forecasts for buildings post redevelopment, which with phased completion dates possibly spanned two Rating Lists. As this was a multimillion-pound scheme, accurate forecasting was an important part of this project. We then worked with the Valuation Office Agency (VOA) and contractors to submit around 150 Checks during the period of phased start dates, arranging inspections and supporting evidence to be supplied to the VOA. Our rate payments team managed the refunds back to the client, ensuring all credits were checked. We then worked the process in reverse to bring the assessments into the Rating List as they were completed or let, working with tenants where appropriate.

Redevelopment scheme -

Business Park

A new client came to us having acquired an office building set over four floors near Reading. Each floor had its own rating assessment. The building had been vacant for some time, while planning permission was sought for the comprehensive redevelopment/refurbishment of the entire building. We served Checks to delete all four assessments and were able to de-rate the floors from the start of the strip out, saving the client over £250,000. We then worked with the client to bring the building back into the Rating List at the right time, mitigating liabilities for our client and their tenants.

Vacant building -

Listed Building

A trade union, progressively needing less space, transformed its freehold head office in Camden, a historic and culturally significant Listed building, into an office and events space. The building now accommodates various businesses, all of varying size and requirements. This property was originally assessed in main, by one large rating assessment. We were instructed to ensure the building reflected how the space was used, ensuring all tenanted space formed individual, separate assessments. This meant when tenants vacated, we were able to apply and obtain Listed Empty Rate Relief, which runs indefinitely until the assessment is reoccupied. This gave our client much needed rate relief for areas which were unoccupied and not receiving income on. This was especially pertinent after COVID-19. We were then able to recuperate refunds issue back to the client, ensuring all rebates were accurate.

Repurposing

Our Clients

Some of the clients we work with.

Key Facts

£9.3bn

total Rateable Value handled

£1.3bn

client savings since 2017, £3.8 bn since 2010

25%

of the FTSE represented

£1bn

rate liability processed each year as UK's leading outsourced ratepayer

Revaluation 2023

Many businesses may have an opportunity to reduce their business rates liability. Are you one of them?

Learn MoreNEWS AND INSIGHTS

Read MoreRating Update – Welsh Budget 2025/26 UBRs and Reliefs

2 weeks ago 3 Mins ReadRating Update – Scottish Budget 2025/26 UBRs and Reliefs

3 weeks ago 5 Mins ReadBusiness Rates for the leisure industry: what lies ahead?

3 weeks ago 3 Mins ReadCookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |