Retail and Restaurants Business Rates

Ensure you pay the correct business rates.

As a retail or restaurant business owner, you will appreciate at first-hand the magnitude of cost that rates are to your business. With our specialist expertise and sector knowledge, we can help you minimise this cost and use all legal means to claim reliefs and allowances. We can also manage rates payments on your behalf and eliminate the associated administrative burden on your business and ensure you only pay what you are legally obliged to.

Impact of Revaluation 2023 on retail and restaurants

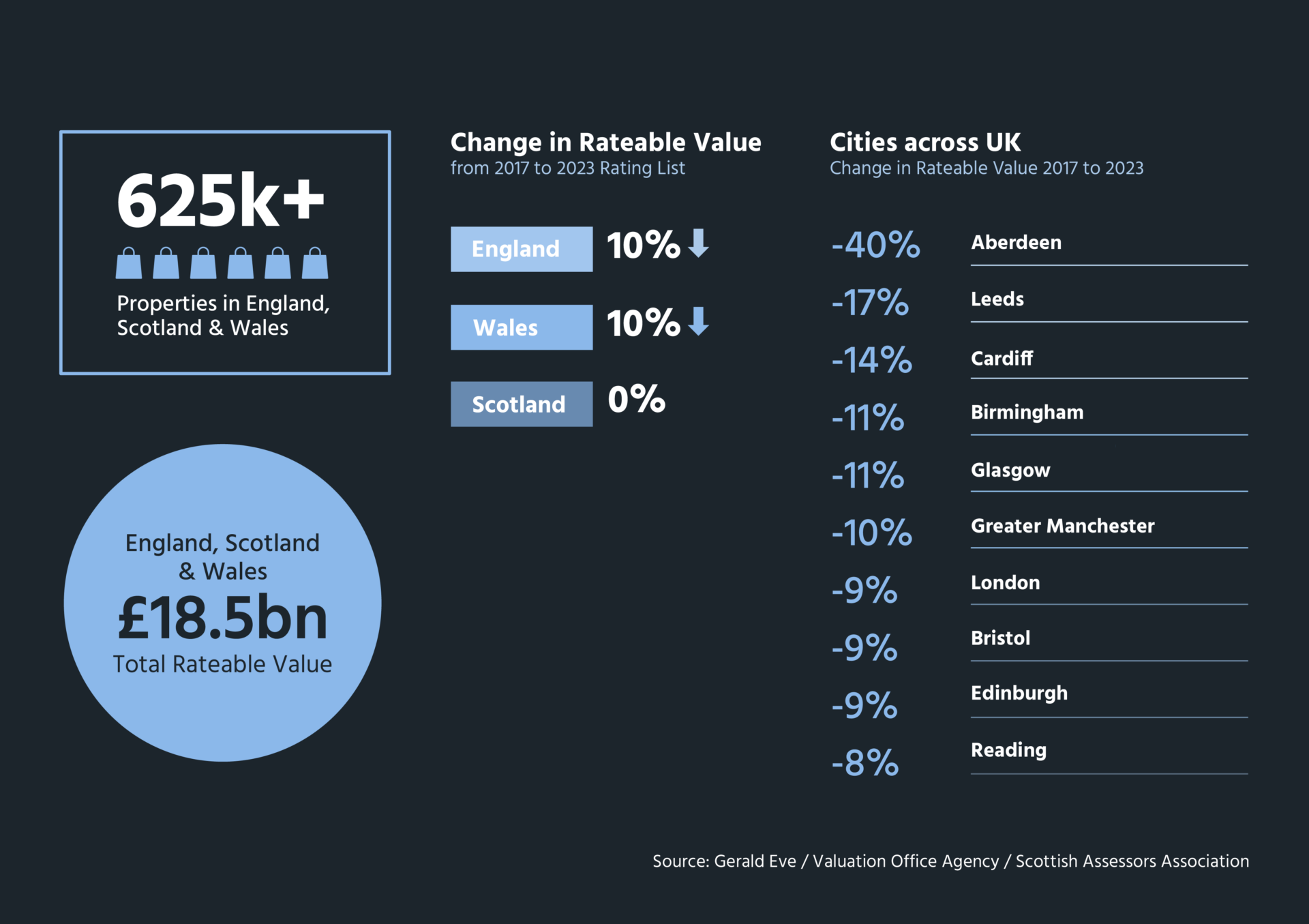

The retail and restaurant sectors have seen many challenges in recent years, but have they been fairly reflected in Reval 2023? These sectors as a whole have benefitted from a 10% reduction in total Rateable Value, but this figure disguises huge variations in value change by region, location and specific use. The total Rateable Value for retail in England has fallen by 10%, but there was no change in Scotland. English convenience store values have risen by 35%, but values for department stores have dropped by 45%. Our analysis of regional and sector variabilities underscores the importance of taking proactive steps to ensure the accuracy of property valuations. By doing so, retail and restaurant operators can better position themselves to navigate the current market.

Catch all of ‘retail’!

The retail sector is hugely diverse, and the value changes reflect the variable fortunes of each sub-sector. The valuation date for the 2023 Revaluation for England and Wales was 1 April 2021, when the UK was in lockdown. Consumer behaviour dictated that convenience, food stores and drive-thrus were trading robustly, whilst many other retailers and restaurant operators’ businesses were suffering from government restrictions to trading and unable to operate at anything like normal.

The COVID-19 pandemic saw the continued growth of online sales and the divergence of sales away from traditional brick and mortar high street premises. These factors were major contributors to numerous retailer administrations and re-structures that occurred over this period.

In Scotland, there was no overall change in retail values, but some regional areas experienced declines, such as Edinburgh and Glasgow, which saw falls of 9% and 11%, respectively. Aberdeen witnessed a substantial fall of 40% for prime retail.

Timing of valuation

A revaluation has always relied on abundant transactional evidence on which to base Rateable Values. The COVID-19 pandemic halted or put a hold on perhaps the majority of leasing activity, ultimately resulting in the vast majority of rent reviews, another good source of rental evidence, being settled as nil increases. This has deprived the Valuation Office Agency of reliable transactional evidence upon which to base Rateable Values as at April 2021.

While England and Wales retained this as their valuation date, Northern Ireland used 1 October 2021 and Scotland pushed their date back a year to April 2022 part in the hope there would be a greater body of transactional evidence. Nonetheless, the pandemic resulted in a move away from traditional lease structures which adopted a market-based rent to a prevalence of turnover rents or a combination of the two.

Given the scarcity of transactional evidence, we believe the reliability of the evidence used by the Valuation Office Agency and Scottish Assessors is questionable and not wholly reflective of the parlous state of the market at the respective valuation dates.

Regulatory compliance

England and Wales

Non-Domestic Rating Act 2023

The Non-Domestic Rating Act 2023 will introduce potentially onerous mandatory obligations on ratepayers to regularly update the tenure and physical details of all properties within their portfolios with the Valuations Office Agency (VOA).

Increasing the administrative burden on businesses, it will require prompt updates to the VOA and annual returns even where there are no changes, with penalty risks for non-compliance. The complexity of business rates management will increase with measures anticipated to be fully in place for the 2026 Revaluation.

Material Change of Circumstance (MCC)

Legislative changes to Material Change of Circumstance provisions took immediate effect in October 2023. They tighten the scope of MCCs in England so that new legislation, licensing regimes and guidance from public bodies will not be grounds for a change in Rateable Value between revaluations.

Completion Notices

For buildings that have been temporarily removed from the rating list during redevelopment, billing authorities will be able to issue Completion Notices in the same way as for a new building. The regulatory changes should be in effect from January 2024.

Scotland

Since January 2023, Scotland’s new legislation has transferred Valuation Appeals to the Scottish Courts Tribunal service. This entails strict deadlines and rigorous requirements for ratepayers and advisors. All appeals against valuations from April 2023 should have been submitted as a comprehensive case with supporting data by 31 August 2023. Learn more about how to appeal business rates in Scotland >

How we can help

Our retail and restaurant business rates specialists combine in-depth experience and industry knowledge with our market-leading data, to achieve effective results for our clients. We are proud to have our expertise recognised by the Valuation Office Agency and Scottish Assessors, with our recommendations sought for the 2017 and 2023 Revaluations. Discover how we simplify business rates for you.

-

Review and Appeal

-

Budgeting and Forecasting

We can provide certainty with the accuracy of rate bills and account for changes in your accrual reports, which are crucial when budgeting for new sites and capital investments.

-

Disturbances and Deletions

As well as advising on the impact of physical changes, including demolitions and temporary disturbances, we also work closely with the Valuation Office Agency and Scottish Assessors to manage and, where possible, ‘prior-agree’ alterations to assessments to reflect these changes.

-

Vacant Properties

We work with clients to explore every opportunity to mitigate their liability. Properties can also become redundant or reach a point beyond economic repair. In these cases, we can investigate opportunities to reduce or delete assessments where appropriate.

-

Exemptions and Reliefs

We ensure reliefs are properly applied. We are at the forefront of devising innovative solutions to problems posed by changes.

-

Historic Rates Audit

Overpayments made against business rates assessments can easily go unnoticed. Billing authority liability calculations can be difficult to understand and errors in calculations are easily overlooked. Our historic rates audit ensures that past errors and overpayments are resolved and refunded.

-

Rates Payment Management Service (RPMS)

Dealing with several rating assessments can be overwhelming, particularly with monthly rates demands being issued by billing authorities (sometimes in error). Demands can be missed or overlooked when sent directly to a site and making payments on all properties can be difficult to keep a record of. Our RPMS team handle thousands of rates payments monthly and have a good rapport with many billing authorities, allowing them to secure refunds of overpaid rates and negotiate payment plans when required. RPMS act on behalf of a number of mineral operators in the UK, making regular payments to avoid summons being issued.

Case studies

-

Rateability of ATMs in host properties

In a seven-year battle with the VOA, we acted for the operator of several thousand ATMs placed in food stores and post offices across the UK, arguing that ATMs should not be separately valued from the host property in which they sit. With support from the likes of Tesco, Sainsbury’s and Co-op, the case was heard at the Valuation Tribunal, Upper Tribunal and Court of Appeal until the Supreme Court, in a unanimous decision, ruled that ATMs and the floorspace on which they sat, were part of the retail offer of the stores within which they were located and should not be separately valued for rates. This commonsense ruling would otherwise have resulted in children’s rides and coffee and drinks machines in shopping centres being individually valued for rates.

Rateability of ATMs in host properties -

Retail park unit in Wales

Our client acquired a store in this park in 2015. The VOA had valued the premises at RV £535,000 which, when the pandemic struck, the assessment exceeded the £500,000 threshold to qualify for the 12-month rates holiday granted by the Welsh Government for the retail and hospitality sectors. We aimed to reduce the assessment to below this threshold and achieve savings for pre and post this period. With the VOA previously having excluded the significant capital contribution our client received from the landlord to take the lease and other relevant evidence, we reduced the assessment to £447,500, resulting in savings of over £500,000.

Retail park unit in Wales -

Fashion retailer in West London

Following an inspection, we found that the floor areas adopted by the VOA were incorrect. The rental evidence on the premises and nearby comparable values proved that the Zone A value adopted by the VOA was also wrong. Part of the premises were vacant and unused, so we approached the billing authority and negotiated temporary relief on the vacant area for three months. Even though our client was in occupation for a relatively short period of time, the total savings were approximately £200,000.

Fashion retailer in West London -

Restaurants at Manchester shopping centre

In certain high-value locations, landlords want various occupiers and uses in their shopping centres to provide shoppers with an optimum retail and restaurant experience. Units in this shopping centre had previously been occupied by retailers but it was clear that restaurant operators would not pay the same level of rent, and that accordingly a revised level of value should be adopted to reflect the change in the use of the property. Tackling both the 2017 and 2023 Rating List assessments simultaneously, we achieved rates savings of nearly £500,000.

Restaurants at Manchester shopping centre -

Retail park in Leicester

At one of the country’s pre-eminent retail parks, we successfully capitalised on our expertise in the retail market sector by establishing that the level of value adopted by the VOA was excessive. We compiled a body of rental evidence and successfully negotiated a reduction in the overall level of value adopted by the VOA from £900.00/sqm to £800.00/sqm, resulting in savings of over £140,000.

Retail park in Leicester -

National supermarket portfolio

Our client acquired a number of retail units across the country. We quickly undertook a detailed inspection programme of each and established that the mezzanine floors installed by the previous tenants had been removed but yet the Rateable Value had not been altered. We submitted a series of checks across the portfolio to have them removed from the Rateable Value. Our proactive approach saved the client in excess of £250,000.

National supermarket portfolio

Key Facts

£9.3bn

total Rateable Value handled

£1.3bn

client savings since 2017, £3.8 bn since 2010

25%

of the FTSE represented

£1bn

rate liability processed each year as UK's leading outsourced ratepayer

Revaluation 2023

Many businesses may have an opportunity to reduce their business rates liability. Are you one of them?

Learn MoreNEWS AND INSIGHTS

Rating Update – Welsh Budget 2025/26 UBRs and Reliefs

1 month ago 3 Mins ReadRating Update – Scottish Budget 2025/26 UBRs and Reliefs

2 months ago 5 Mins ReadBusiness Rates for the leisure industry: what lies ahead?

2 months ago 3 Mins ReadCookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |