University Business Rates

Unlock real savings now, and into the future

If you’re responsible for managing a university estate, you know that it includes a wide range of specialist properties, from student accommodation to research facilities and sporting venues. Determining the appropriate rating assessment can be a complex process. To help you manage this, our national education team provides specialist business rates advice that can save you money and give you greater control over your liabilities. Acting for over 60 universities, we have the experience and knowledge to provide you with the best possible outcomes.

IMPACT OF REVALUATION 2023 ON UNIVERSITIES

Numbers don’t tell the story

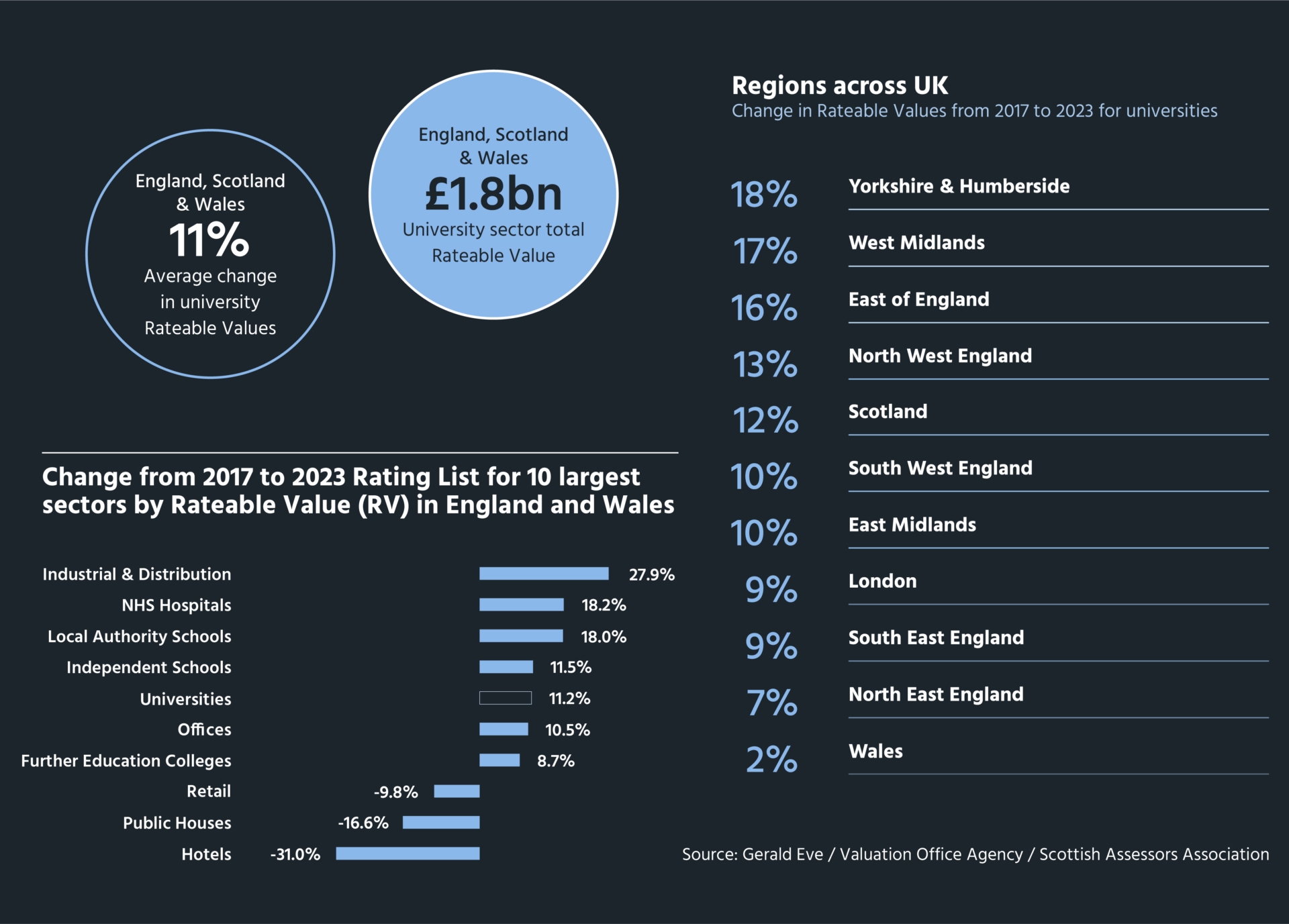

Like many other sectors, universities were adversely affected by the COVID-19 pandemic. At the valuation date for the 2023 Rating List, most campuses remained closed to most staff and students. Despite this, the governments decided not to allow appeals, citing the pandemic’s impact on property rental values. They explained that this would be considered in the 2023 Revaluation.

In contrast to many sectors where Rateable Values reflect the constrained use and enjoyment of property assets during the pandemic, most universities have seen double-digit percentage increases in their Rateable Values in the 2023 Rating List.

Opportunities

University estates tend to be large, complex, and constantly changing. Opportunities to moderate exposure to business rates can arise throughout a revaluation period and can include:

Challenges to the valuation treatment of older, more basic facilities that lack modern building services and sustainability credentials.

Appeals for temporary disturbances arising from refurbishment schemes and other estate remodelling.

Rearrangements of assessments, for example, to remove liability for areas of an estate placed into the hands of a third party.

Allowances for the phased occupation of major new build premises.

Regulatory compliance

England and Wales

Non-Domestic Rating Act 2023

The Non-Domestic Rating Act 2023 will introduce potentially onerous mandatory obligations on ratepayers to regularly update the tenure and physical details of all properties within their portfolios with the Valuations Office Agency (VOA).

Increasing the administrative burden on businesses, it will require prompt updates to the VOA and annual returns even where there are no changes, with penalty risks for non-compliance. The complexity of business rates management will increase with measures anticipated to be fully in place for the 2026 Revaluation.

Material Change of Circumstance (MCC)

Legislative changes to Material Change of Circumstance provisions took immediate effect in October 2023. They tighten the scope of MCCs in England so that new legislation, licensing regimes and guidance from public bodies will not be grounds for a change in Rateable Value between revaluations.

Completion Notices

For buildings that have been temporarily removed from the rating list during redevelopment, billing authorities will be able to issue Completion Notices in the same way as for a new building. The regulatory changes should be in effect from January 2024.

Scotland

Since January 2023, Scotland’s new legislation has transferred Valuation Appeals to the Scottish Courts Tribunal service. This entails strict deadlines and rigorous requirements for ratepayers and advisors. All appeals against valuations from April 2023 should have been submitted as a comprehensive case with supporting data by 31 August 2023. Learn more about how to appeal business rates in Scotland >

How we can help

For the 2017 list, we provided a full rating appeals and consultancy service to over 60 universities across Wales, England and Scotland of all sizes and ages, covering the widest variety of estate and building types. This breadth and depth of experience give us an unparalleled position in our negotiations with the Valuation Office Agency (VOA) and Scottish Assessors Association (SAA) both locally and nationally.

-

Review and Appeal

We know when to challenge and when to leave well alone. Our experience with diverse university estates gives us a real edge in our negotiations. This insight and our forensic attention to detail translate into successful appeal strategies.

-

Budgeting and Forecasting

We can provide certainty over bills and account for future new builds and other changes.

-

Council Tax

Entitlement to various forms of Council Tax exemption has become a contentious issue in recent years. We have the expertise to navigate appeals against unfavourable treatment.

-

Disturbances and Deletions

As well as dealing with disposals, demolitions and temporary disturbances, we also work with Valuation Officers and Scottish Assessors to manage and, where possible, ‘prior-agree’ alterations to assessments to reflect new buildings and other estate changes.

-

Exemptions and Reliefs

As the single most important (and valuable) component of a university’s rate liability calculations, we have expertise in securing and preserving Charitable Relief for university ratepayers – and can provide detailed advice on how quasi-commercial ventures and partnerships can affect your entitlement.

-

Historic Rates Audit

Our historic rates audit ensures that past errors and overpayments are resolved and refunded.

-

Rates Payment Management Service (RPMS)

We offer the market-leading rate payment management service to ensure you only ever pay the correct rates liability.

-

Vacant Properties

We can achieve empty rate relief for our university clients through various mitigation strategies. We have extensive experience assisting universities that may be coming out of properties pending future disposal, where considerable liability risks can arise.

Case Study

-

Deletion of empty building

Following a university’s purchase of an office building adjacent to its main campus for strategic ‘land banking’ which resulted in a 100% empty rate liability, we used emerging case law to have the old office assessments taken out of rating following their initial stripping-out, saving the client £1.6 million.

Deletion of empty office building subject to redevelopment -

Council Tax reductions

A university client discovered that one of its student residences contained construction defects which undermined its fire compliance. We prepared an appeal to the Valuation Tribunal against the billing authority’s refusal to grant exemption for the initial unoccupied period and subsequently agreed to delete the entries with the VOA saving the client over £180,000.

Council Tax reductions following fire safety concerns -

Major assessment reduced

We advised a university on their main campus business rates, focusing on revising building costs and adopting the new Gerald Eve derived age and obsolescence scale. Following negotiations with the Valuation Office Agency, we achieved a reduced assessment providing savings of £600,000.

Major university assessment reduced -

Reduction on alternative valuation basis

Following the leasing of a building by a university and its redevelopment as a specialised higher education facility we took forward checks and challenges seeking a change of valuation basis from the comparable ‘rentals’ approach to the cost-based ‘contractors’ approach. As a result of the negotiation with the Valuation Office Agency we agreed a reduced assessment with savings of around £310,000.

New university building reduced on alternative valuation basis -

Review of unit

Having been appointed by a new client we undertook a full estate review and identified opportunities to combine multiple assessments. Having made a check and then a challenge we prevailed upon the Valuation Office Agency to undertake a full joint inspection to demonstrate the degree of contiguity required to merge the existing entries in the rating list providing for rate savings in excess of £560,000.

Review of unit of assessment unlocks reduced liability -

Redevelopment of university

As part of a major redevelopment of a university campus several major new facilities were delivered including a new learning resource centre and sports facility. Although the predecessor facilities remained in-situ for some time after the completion of their replacements, we were able to ensure their removal from the campus rating assessment on the grounds of total functional and economic redundancy providing savings of over £50,000.

Redevelopment of university provides opportunity to reduce assessment

Why us?

We are sector specialists.

Saving Money

Our distinctive work in the university sector has included negotiating a Memorandum of Agreement with the Valuation Office Agency. These efforts in the 2017 Revaluation led to significant reductions in build cost rates and the adoption of the 'Gerald Eve' depreciation scale, a marked improvement over the former 'Monsanto' scale. Looking ahead, we aim to spearhead negotiations for the 2023 valuation scheme. Our approach acknowledges the need for various valuation methods and negotiation tactics due to the diversity of building types across universities.

Budgeting

Every phase of the building lifecycle, from acquisition to development, needs meticulous management of business rates for optimal results. Our liability forecasts enable accurate budgeting and incorporate estimates for new buildings by building or department, calculated by both the rate year and the financial year.

Minimising Risk

We provide essential strategic guidance, empowering universities to manage their business rates effectively. Our support ensures financial predictability, compliance with dynamic legislative changes, and adaptability to shifting economic landscapes.

Key Facts

9.3bn

total Rateable Value handled

£1.3bn

client savings since 2017, £3.8 bn since 2010

25%

of the FTSE represented

£1bn

rate liability processed each year as UK's leading outsourced ratepayer

Revaluation 2023

Many businesses may have an opportunity to reduce their business rates liability. Are you one of them?

Learn MoreNEWS AND INSIGHTS

Read MoreRating Update – Welsh Budget 2025/26 UBRs and Reliefs

2 weeks ago 3 Mins ReadRating Update – Scottish Budget 2025/26 UBRs and Reliefs

3 weeks ago 5 Mins ReadBusiness Rates for the leisure industry: what lies ahead?

3 weeks ago 3 Mins ReadRelated resources

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |